In the US, they tax a lot of things that are bad for you, like tobacco, alcohol, and soda. These are called “sin taxes” and are meant to discourage behavior that’s harmful to society. But do they work?

In the US, they tax a lot of things that are bad for you, like tobacco, alcohol, and soda. These are called “sin taxes” and are meant to discourage behavior that’s harmful to society. But do they work?

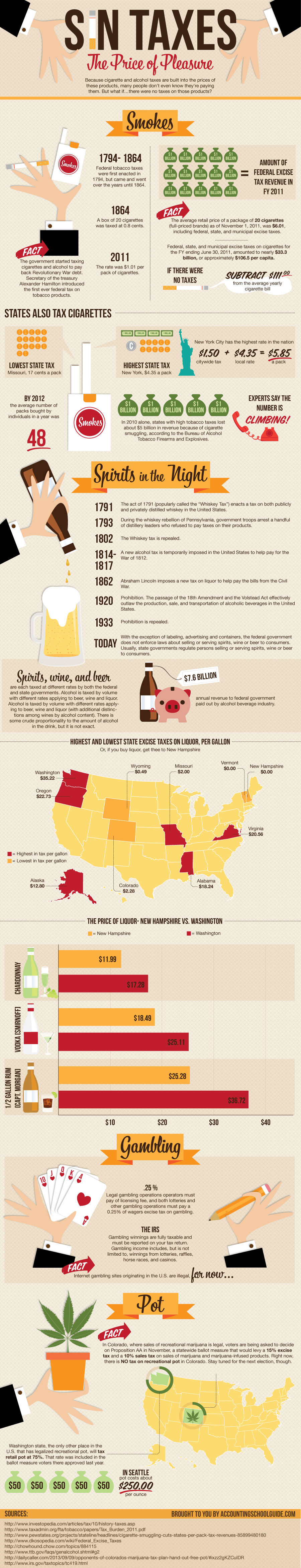

The idea of taxing things that are bad for us like tobacco, alcohol, and, soda goes back a long way. 90% of US tax revenue between 1863 and 1913 came from taxes on tobacco, wine, liquor, and beer and while they make up less overall revenue today they’re not uncommon. In fact, some states rely heavily upon.

So yes, sin taxes work as far as bringing in money but do they actually stop sins?

Taxes on tobacco have shown to lower smoking rates and improve public health and higher prices on alcohol could help reduce some of its consequences like underage drinking and alcohol-related driving accidents.

What about soda? There aren’t a lot of statistics yet because soda taxes aren’t as common but a sin tax on soda is not a new idea. The idea of taxing soda because it’s unhealthy has been talked about for decades and soda and sugar taxes have been implemented around the world. However, the first one to pass in the US was only in 2015, and early results are positive with soda consumption down 20% in some neighborhoods.

Critics argue that sin taxes are aggressive, disproportionately affecting the poor. They also point out that buying less soda doesn’t mean someone isn’t choosing something just as unhealthy.

With lots of money coming from both sides of the debate, the argument about the benefits or detriments of sin taxes is likely to continue for years.